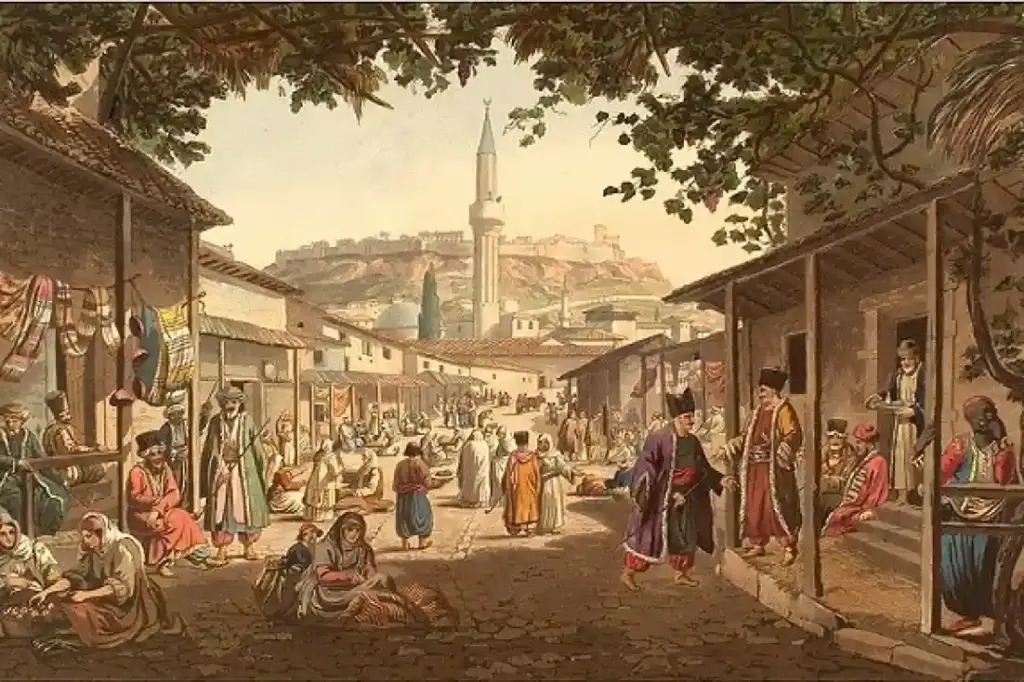

In the Ottoman Empire, the taxation system was a complex and integral part of its administration, affecting every village and town. Taxes were not only a means of revenue but also a tool for maintaining control and order within the empire. This article explores the various taxes imposed on villages and towns, shedding light on how these obligations influenced daily life and the socio-economic structure of the Ottoman society. Join us at DirilisPK as we delve into the intricate details of the taxation system and its impact on the villages and towns obliged to pay taxes in the Ottoman Empire.

In the Ottoman Empire, villages and towns that were obliged to pay taxes formed the cornerstones of the economic and administrative structure of the empire. The Ottoman Empire collected various taxes in the conquered lands in order to ensure the security of the people, to finance public services and to maintain the power of the state. These taxes were determined according to the income, production capacity and social status of the people living in the villages and towns. In this article, the structure of the tax system in the Ottoman Empire, tax types, tax liabilities of the people living in the villages and towns and the social and economic effects of this tax system will be discussed in detail.

Structure of the Ottoman Tax System

The Grooming System

The basis of tax collection in the Ottoman Empire was the timar system. The timar system was based on the state dividing lands into pieces called dirlik and distributing these lands to soldiers or civil servants in state service. Timar owners were responsible for collecting taxes from villages and towns in a certain region. The collected taxes were used to provide for the timar owner’s livelihood and to finance the military force in the region.

The Ilmiye Class and Tax Collection

In the Ottoman Empire, the scholar class also played an important role in tax collection. Judges and lecturers were responsible for ensuring justice in villages and towns and for the correct collection of taxes. The taxes collected under the supervision of the scholar class were transferred to the state treasury and used to finance public services.

Notables and Tax Collection

From the 18th century onwards, local power holders called ayans in the Ottoman Empire began to play an important role in tax collection. During periods when central authority weakened, ayans held the authority to collect taxes in villages and towns. While a portion of the taxes they collected was transferred to the state, the rest was used for the needs of their own regions.

Tax Types of the Ottoman Tax System

Tithe

One of the most common types of taxes in the Ottoman Empire was the tithe. The tithe was a type of product tax collected from the people engaged in agriculture in the villages. The tithe rate was usually determined as ten percent of the product. This tax was collected from agricultural products such as wheat, barley, corn, olives, and grapes. The tithe was determined according to the production capacity of the village people and the amount of the product.

Jizya

Jizya was a tax collected from non-Muslim people in the Ottoman Empire. This tax, paid by non-Muslim men, was collected within the framework of the policy of religious tolerance and toleration. Jizya was considered a tax that non-Muslims paid to ensure the safety of their lives and property and to live under the protection of the state.

Bantam

İspenç was another type of tax collected from Christian peasants in the Ottoman Empire. İspenç tax was a type of rent tax that peasants paid in exchange for using their land. This tax was usually collected during the harvest season and was determined according to the peasants’ income.

We are avariz

The avarız tax is a type of tax collected in extraordinary circumstances. This tax, collected due to war, natural disasters or other emergencies, was collected from the people in villages and towns. The avarız tax was limited to a certain period and was terminated when the need was met.

Villages and Towns Obliged to Pay Taxes in the Ottoman Empire: Tax Obligations in Villages and Towns

Tax Obligations of Villagers

In the Ottoman Empire, the people living in villages and towns that were obliged to pay taxes were engaged in agriculture and animal husbandry and paid taxes at certain rates on the products they produced. In the Ottoman Empire, the most important tax obligations of the villagers in the villages and towns that were obliged to pay taxes were the tithe and ispenç taxes. In addition, the villagers were also obliged to pay land rents, animal taxes and various other taxes.

Tax Obligations of Townspeople

In the Ottoman Empire, the people living in villages and towns that were obliged to pay taxes were engaged in trade, crafts, and various professions. The most important tax obligations of the townspeople included craftsmen’s taxes, trade taxes, and various license taxes. In addition, non-Muslim people living in towns paid the jizya tax.

Tax Collection Methods

In the Ottoman Empire, tax collection was generally carried out by local administrators, judges and timar owners. Taxes were collected in cash or in kind. In the Ottoman Empire, in villages and towns that were obliged to pay taxes, the same tax was paid with agricultural products or animals produced by the villagers. During the tax collection process, an attempt was made to determine a fair tax rate by taking into account the income status and production capacity of the people.

Social and Economic Impacts of the Tax System

Social Impacts

The tax system in the Ottoman Empire played an important role in shaping the social structure. The tax collection process increased the people’s loyalty to the state and strengthened the power of the central authority. In addition, the fair application of the tax system contributed to the establishment of peace and trust among the people. However, the heavy tax burden occasionally caused dissatisfaction and rebellions among the people.

Economic Impacts

In the Ottoman Empire, the tax system played an important role in regulating economic activities and strengthening the financial structure of the state. The collected taxes were used to finance public services, meet military expenses and carry out infrastructure projects. In addition, the tax system contributed to the development of economic activities and the increase in production capacity in villages and towns.

Changes in the Tax System

Tanzimat Period

The Tanzimat reforms carried out in the Ottoman Empire in the 19th century also led to significant changes in the tax system. The Tanzimat period aimed to strengthen the central authority and limit the powers of local administrators. During this period, tax collection was made more orderly and transparent, and the tax burden on the people was tried to be eased.

The Republican Period and Tax System

With the end of the Ottoman Empire and the establishment of the Republic of Turkey, radical changes were made in the tax system. With the Republican era, a modern and centralized tax system was established and a fair tax rate was determined according to the income of the people. In addition, tax collection began to be carried out more professionally and effectively.

As a result, the villages and towns that were obliged to pay taxes in the Ottoman Empire formed the cornerstones of the economic and administrative structure of the empire. In this article, the structure of the tax system in the Ottoman Empire, the types of taxes, the tax liabilities of the people living in villages and towns, and the social and economic effects of this tax system are discussed in detail. The Ottoman tax system played an important role both in shaping the social structure and in regulating economic activities. The reforms carried out in the tax system during the Tanzimat period and the Republic period eased the tax burden on the people and made the tax collection process more organized and transparent.

Conclusion

In conclusion, the taxation system in the Ottoman Empire played a crucial role in shaping the economic and social landscape of its villages and towns. The diverse and often burdensome taxes imposed on these communities were a reflection of the empire’s administrative complexity and its need for revenue. By understanding the obligations and challenges faced by these villages and towns, we gain a deeper appreciation for the resilience and adaptability of the Ottoman society. Explore more about the fascinating history of Ottoman taxation on DirilisPK, where we bring the rich tapestry of the empire’s past to life.